Oct 23, 2024 | Business Growth, Business Valuations, Exiting A Business, Small Business, Succession Planning

Your successful business can quickly start to lose value if you don’t keep pace with a changing market. Check out these five threats that could be undermining the value of your business. Once you’ve built up a successful business, you’ll want to see a healthy return...

Oct 18, 2024 | Small Business, Succession Planning, Taxation, Trust Accounts

Family trusts can be an important tool for protecting and distributing wealth within families in Australia. Whether you’re interested in shielding your assets, benefiting from tax advantages, or simply planning for the future, a family trust offers an effective...

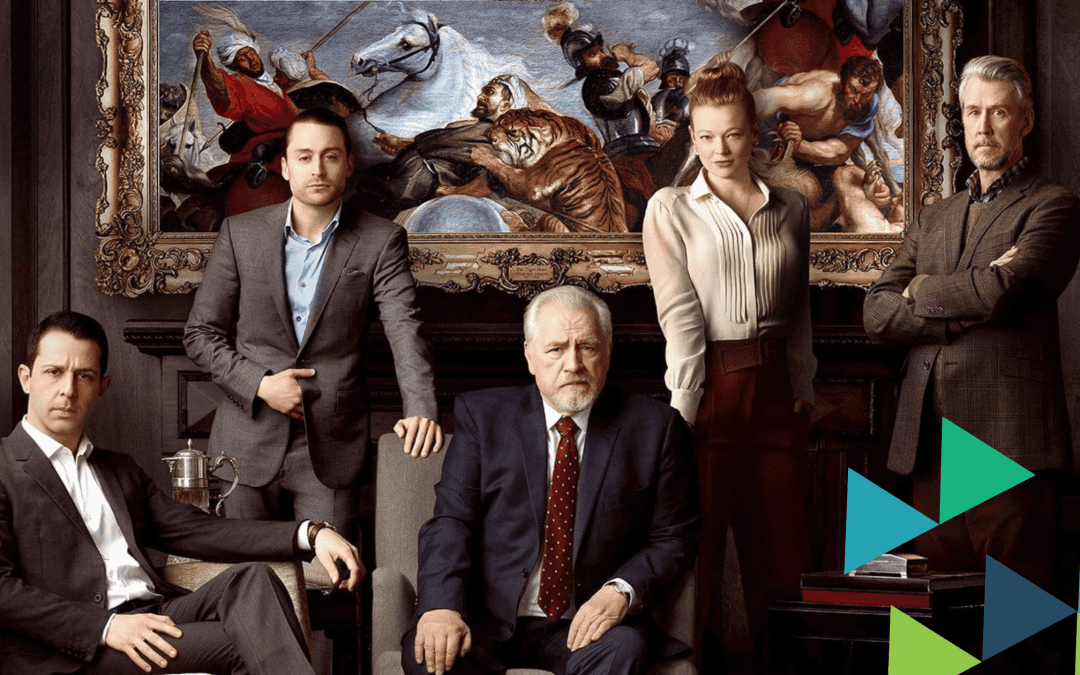

Aug 11, 2023 | 2023, Exiting A Business, Succession Planning

What is the end game for your business? Succession is not just a topic for a TV series or billionaire families, it’s about successfully transitioning your business and maximising its capital value for you, the owners. When it comes to generational succession of a...