We thought this article might summarise for you what’s on the public record surrounding the new federal government’s tax policies.

Introduction

The recent federal election resulted in a change of government with the Labor party returning to the Treasury benches for the first time since 2013. After a protracted vote count, they will form a majority government – not needing to rely on independents or minor parties to get their proposals through the lower house at least. Although their tax position/proposals are not as wide-ranging or bold as when they last sought government in 2019 – where halving the CGT discount, scrapping the refund of excess franking credits, and taxing trusts more harshly were all part of their platform – there are still some significant positions that have been taken, with no doubt more to be revealed in the upcoming federal budget in October 2022.

Personal income tax cuts

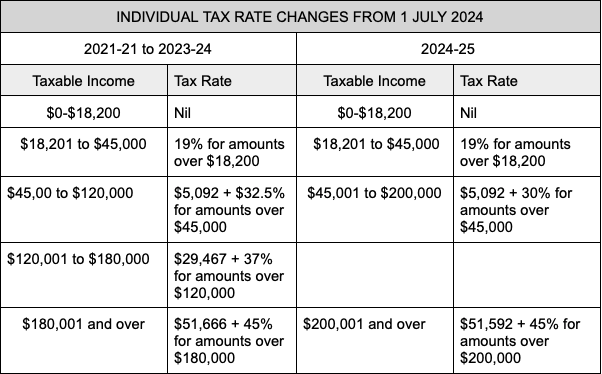

The new government has committed to supporting the so-called “Stage 3” tax cuts that were passed into law by the former government in mid-2019.

The Stage 3 cuts will:

- increase the income at which the top tax bracket of 45% applies from $180,001 to $200,001

- remove the 37% bracket which previously applied to incomes from $120,001 to $180,000

- lower the income tax rate from 32.5% to 30% for the new bracket that extends from $45,001 to $200,000.

While earlier stages of the tax cuts were geared to lower income earners, Stage 3 clearly favours higher income earners in both dollar and percentage terms. While those earning $45,000 or less a year will get nothing from the tax cut; those earning $60,000 will be $375 better off per year; those earning $90,000 will be $1,125 better off; while those earning $200,000 will be $9,075 better off. Casting forward two years, this change will present some tax planning opportunities for higher income earners including deferring income and capital gains until after 30 June 2024 where possible.

Multi-national tax crackdown

A four-pronged approach will be taken:

- supporting the OECD’s Two-Pillar Solution for a global 15% minimum tax, and ensuring some of the profits of the largest multinationals– particularly digital firms – are taxed where the products or services are sold.

- limiting debt-related deductions by multinationals at 30% of profits, consistent with the OECD’s recommended approach, while maintaining the arm’s length test and the worldwide gearing ratio.

- limiting the ability for multinationals to abuse Australia’s tax treaties when holding intellectual property in tax havens.

- introducing transparency measures including reporting requirements on tax information, beneficial ownership, tax haven exposure and in relation to government tenders.

Electric car discount

A proposal that went somewhat under the radar during the election campaign was the announcement of an electric car discount designed to make these vehicles more affordable for individuals and employers. Under this policy, the new government will exempt many electric cars from:

- Import tariffs – this is a 5% tax currently imposed on some imported electric cars, and

- FBT – where they are provided by an employer to employees who use them for private use.

These exemptions will be available to all electric cars below the luxury car tax threshold for fuel efficient vehicles (which is currently $79,659 in 2021-22). The new government says that the Electric Vehicle Council estimates that a $50,000 model (such as the Nissan Leaf) will be more than $2,000 cheaper as a result of removing the import tariff. The FBT exemption will make salary packaging more attractive. If a $50,000 model is provided through employment arrangements, government modelling says its FBT exemption will save employers up to $9,000 a year (noting that FBT is a tax which is often passed onto employees). Savings will be even higher for more expensive models (up to the luxury car tax threshold). The new policy is intended to apply from 1 July 2022, and will be reviewed after three years in order to gauge the take up of electric cars at that time.

You can read more about this on another article we have published on our site here.

Section 100A and trust distributions

Little is known about the incoming government’s views on the ATO’s recent crackdown on trust distributions by applying section 100A of the Tax Act to what have long been accepted dealings by trustees when distributing trust income to beneficiaries. Many thousands of small businesses who thought they were following trust distribution practices that have been in common use for decades could now be facing a whole different landscape moving forward, depending on how the ATO guidance is finalised, the outcome of litigation currently before the courts, and any legislative action that the new government may wish to take. All we know about the incoming government’s views is that they seem to be opposed to the ATO’s new approach being imposed retrospectively (this is based on Labor’s then Shadow Assistant Treasurer Stephen Jones’ comments in April 2022 at a public event run by one of the accounting bodies).

Retrospectivity has largely become a moot point anyway, with the ATO’s Deputy Commissioner Louise Clark confirming that the ATO will not be pursuing taxpayers that entered into arrangements between 1 July 2014 and 30 June 2022 where, in good faith, they concluded that section 100A did not apply to them based on the previous 2014 guidance.

So, the only real battlefield now is how the law will apply going forward, and whether the incoming government will take any legislative action or whether it will just let the ATO’s new (eventually finalised) guidance apply…which itself is subject of course to the outcome of the litigation in the Guardian case which is currently before the Full Federal Court.

Other measures

Once the new government gets it feet under the desk and perhaps more likely when it delivers its first budget in October, we may get more of an idea around the fate of other tax changes which are still up in the air including:

- the former government’s big-ticket tax proposal in the March 2022 Budget of a 120% deduction incentive for training and digital uptake aimed at small businesses;

- a change to the patent box regime, extending it to cover certain agricultural and environmental protection activities; and

- the tax bills that were still before the Senate and House when the Parliament was dissolved, including new rules enabling small businesses to apply to the AAT for ATO debt recovery action to be paused while the debt is still in dispute before the tribunal.

As always, please reach out to our TSP team for more information on any of the above items. Go to our contact us page here

- From Air Fryers to Swimwear: Tax Deductions To Avoid - 04/06/2025

- How TSP Helps Newcastle Businesses with Tax Compliance - 23/05/2025

- Year-end Tax Planning: Opportunities & Risks - 16/05/2025